are campaign contributions tax deductible in 2019

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. Employees 50 and up may contribute an additional.

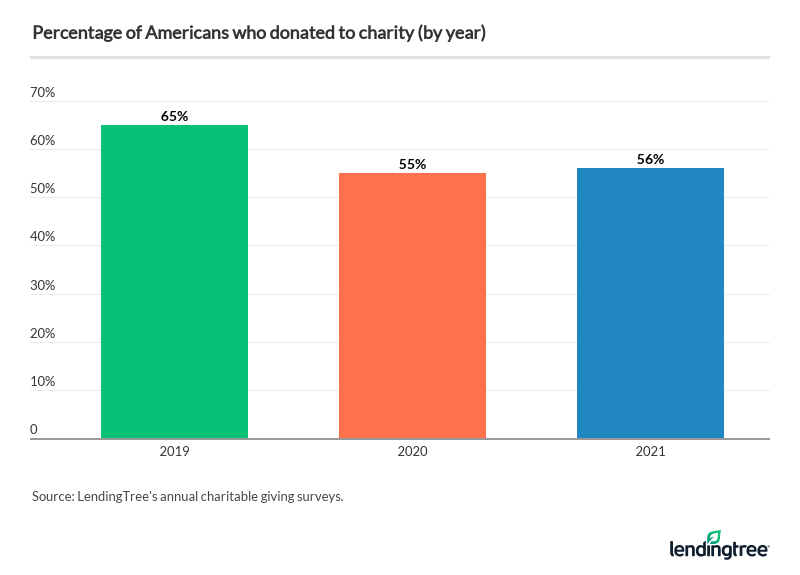

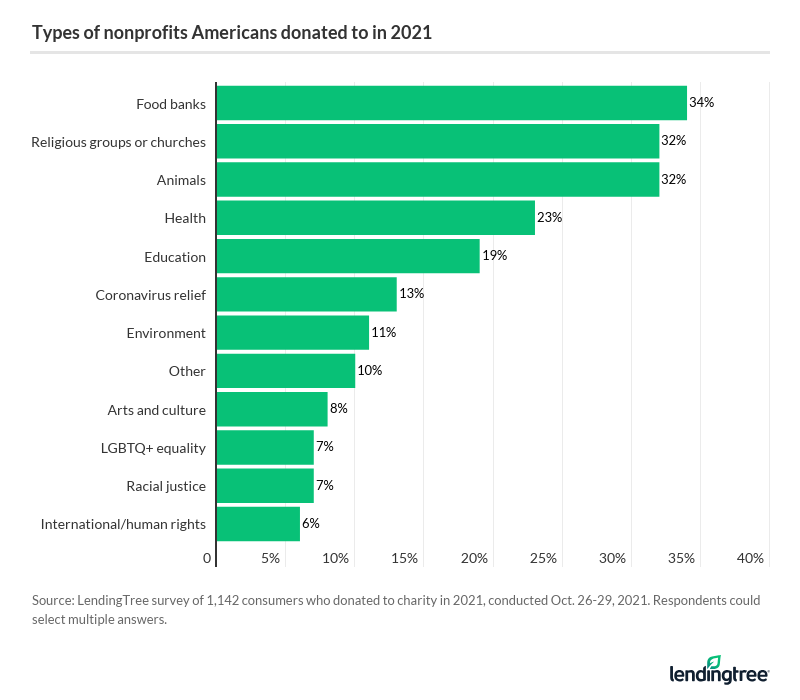

56 Of Americans Donated To Charity In 2021 Lendingtree

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

These laws must be read with the. Generally individuals cant deduct business entertainment expenses until the 2026. And since all participating recipients.

Qualified contributions are not subject to this limitation. To put it another way financial donations to political campaigns are not tax deductible. For 2019 the standard deduction is 12200 for single filers and 24400 for joint filers.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. Generally a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year. When people do give most political donations are large given by a few relatively wealthy people.

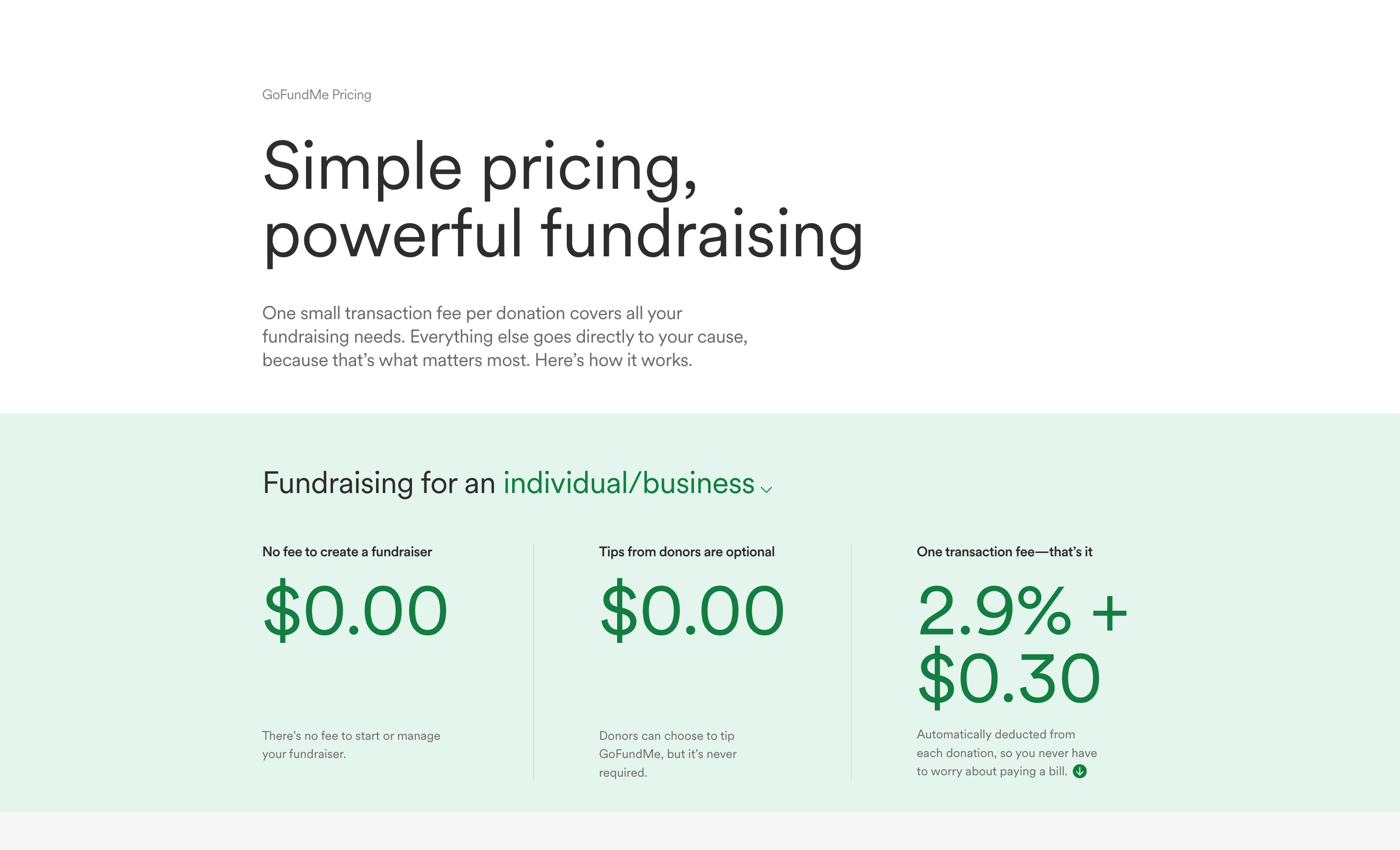

The answer is no. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Individuals may donate up to 2900.

As clarified campaign contributions are exempt from donors tax only during the exclusive period for campaigning as scheduled by the comelec. What are the Campaign Contributions Limits. You can receive up to 75 percent of your first 400 of donation as credit followed by 50 percent of any amount between 400 and 750 and 333 percent of amounts over 750.

This stems from the presumption that. On the part of the candidate to whom the contributions were given Revenue Regulations 7-2011 provides that as a general rule the campaign contributions are not. The Federal Election Commission says an individual can only donate.

For 2019 annual employee contribution limits are 19000. The same goes for campaign contributions. Generally only a small minority of total contributions come from those who.

As a result you may not itemize deductions this year even if youve consistently done so in the. Up to 2700 per candidate per election up to 10000 to. Are campaign contributions tax deductible in 2019.

Elon Musk Tesla Spacex Spend Millions To Influence Politics And Policy

Infographic Designed By Http Intendcreative Com And Referenced In Nonprofit Marcommunity Article Nonprofit Infographics Nonprofit Annual Report Infographic

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

The Stimulus Payment Trick Youtube Word App Payment Words

Charity Organisation Charity Organisation Jobs Apps

Cee Index Of Excellence In Stem Education Stem Education Education Excellence

Alberta S 600 Billion Federal Contribution Leaves Fairness In The Eye Of The Beholder The Hub

Best Donation Cards Template Card Templates Free Card Templates Printable Card Template

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful

Alberta S 600 Billion Federal Contribution Leaves Fairness In The Eye Of The Beholder The Hub

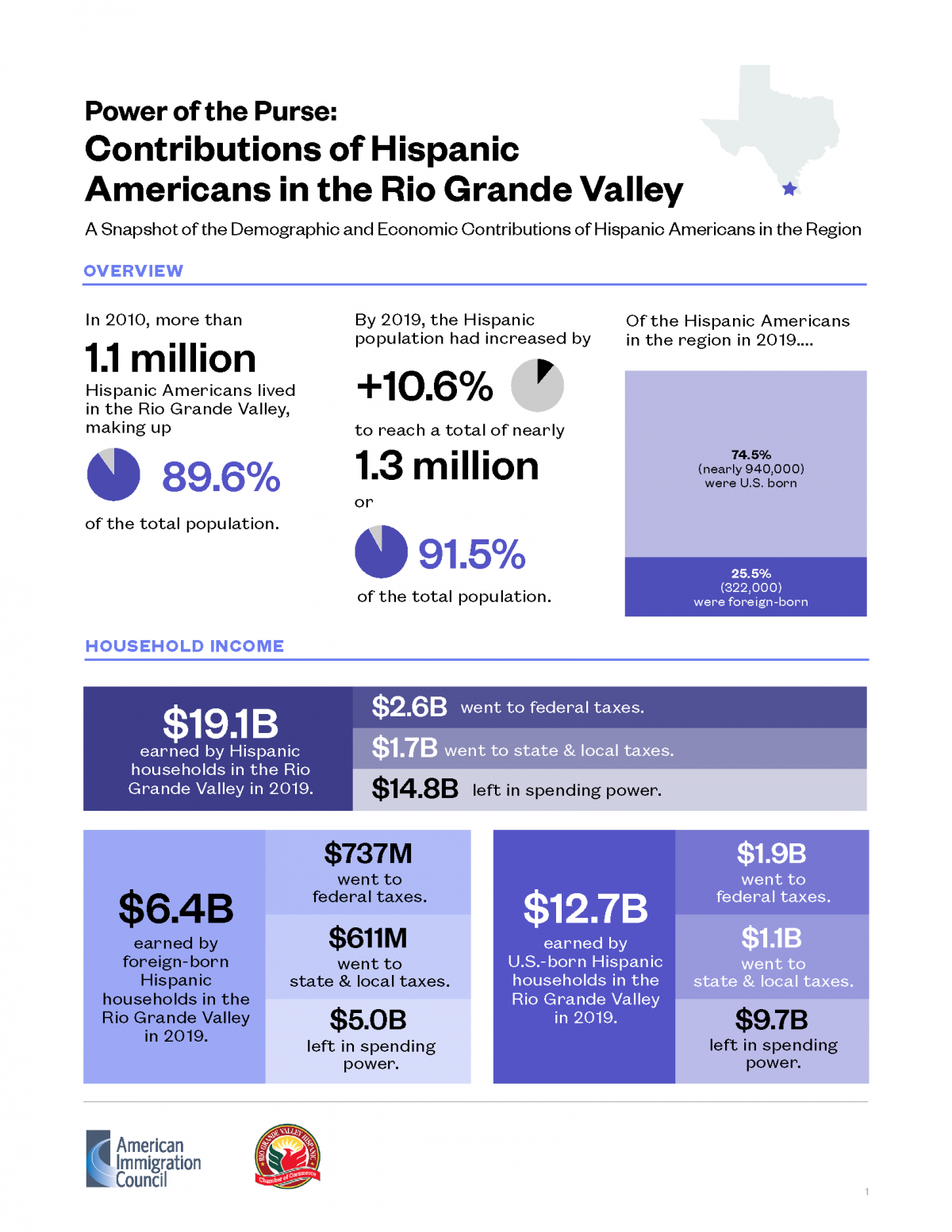

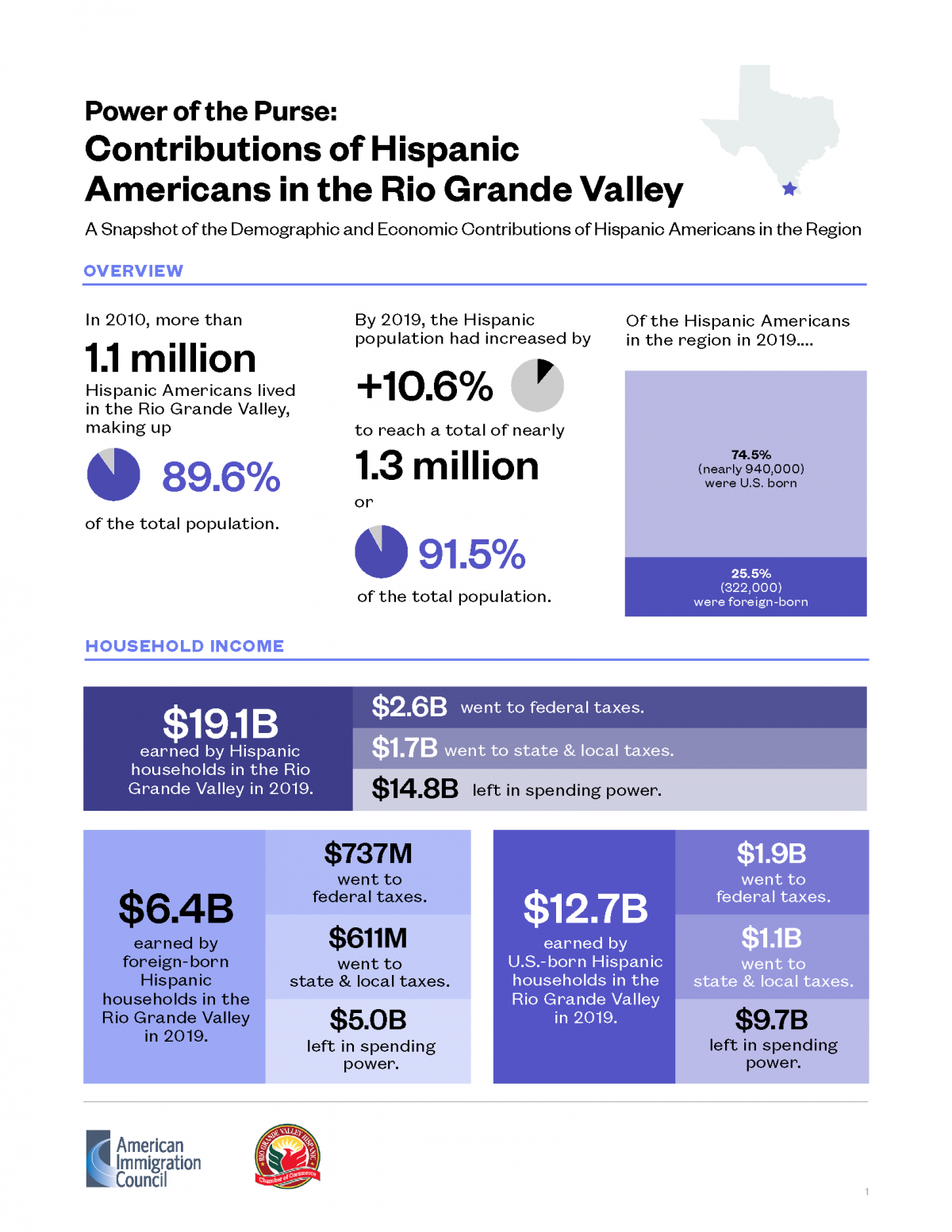

Tax Contributions American Immigration Council

Alberta S 600 Billion Federal Contribution Leaves Fairness In The Eye Of The Beholder The Hub

56 Of Americans Donated To Charity In 2021 Lendingtree

Harvard Received 1 4 Billion In Donations Last Year Infographic

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox Donation Letter Donate Fundraising Letter

Image Result For Monthly Commitment Card Card Templates Printable Templates Printable Free Card Template

Donation Pledge Card Template 8 Sample Pledge Forms Pdf Word Pledge Card Template Lesson Plan Template Free